What is Payment Orchestration?

Payment Orchestration is a relatively new term, one that encompasses concepts that most merchants may already be familiar with. The term refers to all of the software systems and services that automate the coordination and management of business operations involved in authorizing, processing, and optimizing payments..

Enjoying our content? Make sure to sign up for our newsletter

Why Merchants Need a Payments Orchestration Solution

Payment stacks aren’t so straightforward anymore. They’re loaded with an increasing number of functionalities, components, and elements, which are making them less efficient at processing payments and more challenging to manage. They have grown more intricate and multifaceted in response to rising consumer demand for convenience and complexities in today’s payment ecosystem. With so many fragmented layers and a patchwork of software systems stacked on top of existing legacy infrastructures, current payment stacks have turned from an asset to a liability – they are simply not designed with enough flexibility, interoperability, or intelligence to keep up with the growing complexities of today’s payments ecosystem.

With so many fragmented layers and a patchwork of software systems stacked on top of existing legacy infrastructures, current payment stacks have turned from an asset to a liability – they are simply not designed with enough flexibility, interoperability, or intelligence to keep up with the growing complexities of today’s payments ecosystem.

If we take a look at the process of authorizations for example, these have become far more complicated as the growth of cross-border transactions continues to snowball. Compliance with different regulations, card scheme standards, and combating fraud have also become harder. And that’s not to mention the difficulties in navigating a maze of processing costs and fees, the need to integrate and manage multiple local payment providers, methods, and currencies, are driving merchants to find the smartest, most efficient solution possible.

Key Functionalities of Payment Orchestration

An advanced payments orchestration panel should have the following key functionalities, all consolidated into a single-layered architecture:

– Dynamic Transaction Routing

– Application Programming Interface (API)

– Advanced Analytics & Reporting

– Risk Management

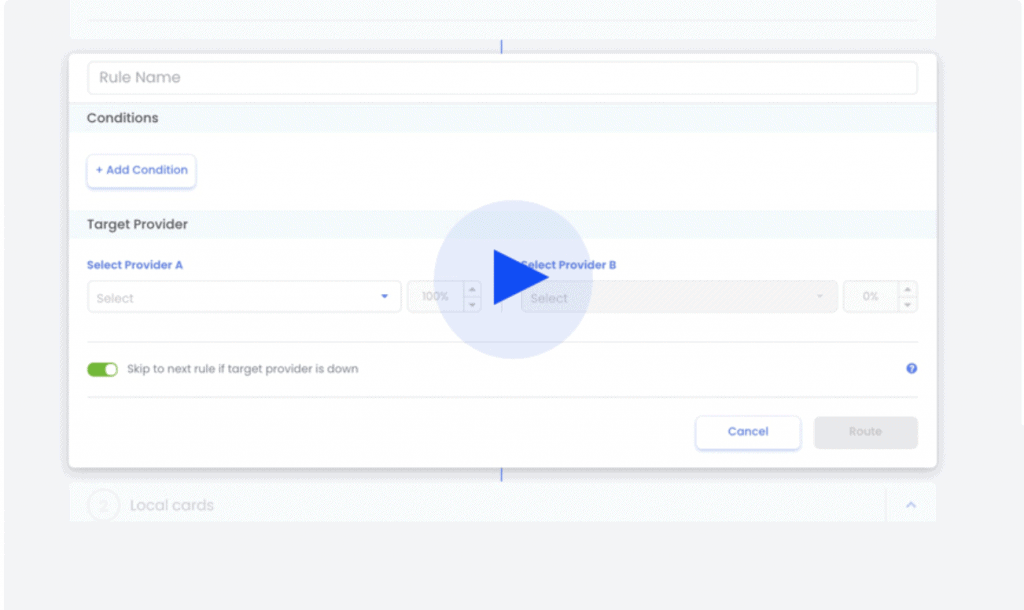

Dynamic Transaction Routing

Dynamic transaction routing delivers merchants greater flexibility and control over their payment flows, which has several financial benefits. For example, when a decline occurs, merchants can switch to a second acquirer to obtain approval, reducing the rate of lost transactions and providing a better customer experience.

Dynamic transaction routing also makes it possible to switch transactions to another provider should a payment processor experience an outage. Routing also allows for better costs-saving, because merchants can set rules that dictate routing via the lowest cost provider.

Application Programming Interface (API)

Payment orchestration panels are of vital importance to merchants with global operations who must work with multiple providers to deliver the best customer experience. In contrast to fragmented and multilayered payment architectures, adding new providers through an advanced orchestration panel does not require large amounts of time or money for complex integration processes. A well-architected payment orchestration panel is agnostic and brings more advanced capabilities to integrate new providers, methods, currencies at speed. It provides the flexibility to connect to a multitude of end-points through a single API, saving time, money, and also helping merchants move into new markets faster.

Advanced Analytics & Reporting

Advanced payment orchestration panels can deliver deeper insights by providing access to real-time and consolidated payments data through dashboards, reporting, and alerts. With more advanced analytics, merchants will have better opportunities to optimize their payments and understand which areas need to be focused on to increase revenue. When it comes to reporting, merchants gain added capabilities to create and download cross provider reports based on business needs and compare and evaluate payment service provider performance. There should also exist the capacity to segment transaction reporting by business unit, and because transaction data is shared with acquirers, PSPs, banks, and other entities, merchants can use the data to build consolidated reports or make any number of custom reports.

Risk Management

A well-architected payment orchestration panel should also offer functionalities to help merchants lower their operational costs and minimize exposure to the Payment Card Industry data (PCI) security standard. By providing a PCI compliant token vault to store sensitive payment data, an advanced payments orchestration panel reduces a merchants PCI scope, resulting in a lowering of compliance related expenses. A well-architected orchestration panel will also usually support multiple token formats and employ a universal standardized token which can be passed back to all merchants. Some orchestration panels will include their own purpose-built risk and fraud management tools as well, to aid merchants in their management of risk and keep customers secure across all channels.

What is the Right Payment Orchestration for You?

Merchants – especially those experiencing hyper-growth – have a growing need for a well-architected, and agnostic platform which will allow them to tackle difficulties in their online payments and most importantly – to optimize their payments.

ZOOZ provides an open, and agnostic payment-platform, filled with tools to make the optimization process for merchants easier, and more flowing.

Thanks to the ability to connect to various providers via a single API, integration becomes a breeze. Tools such as the instant retry save merchants millions of dollars by allowing them literally save failed transactions, while the agnostic nature of the platform gives them transparency as for the cost of each and every one of their providers, as well as their performance over time. This smart, and data-filled overview, empowers our customers to scale their payments easily, and see their bottom-line results immediately.

Contact ZOOZ today to try our payment orchestration platform for yourself.